- Home

- Healthcare

-

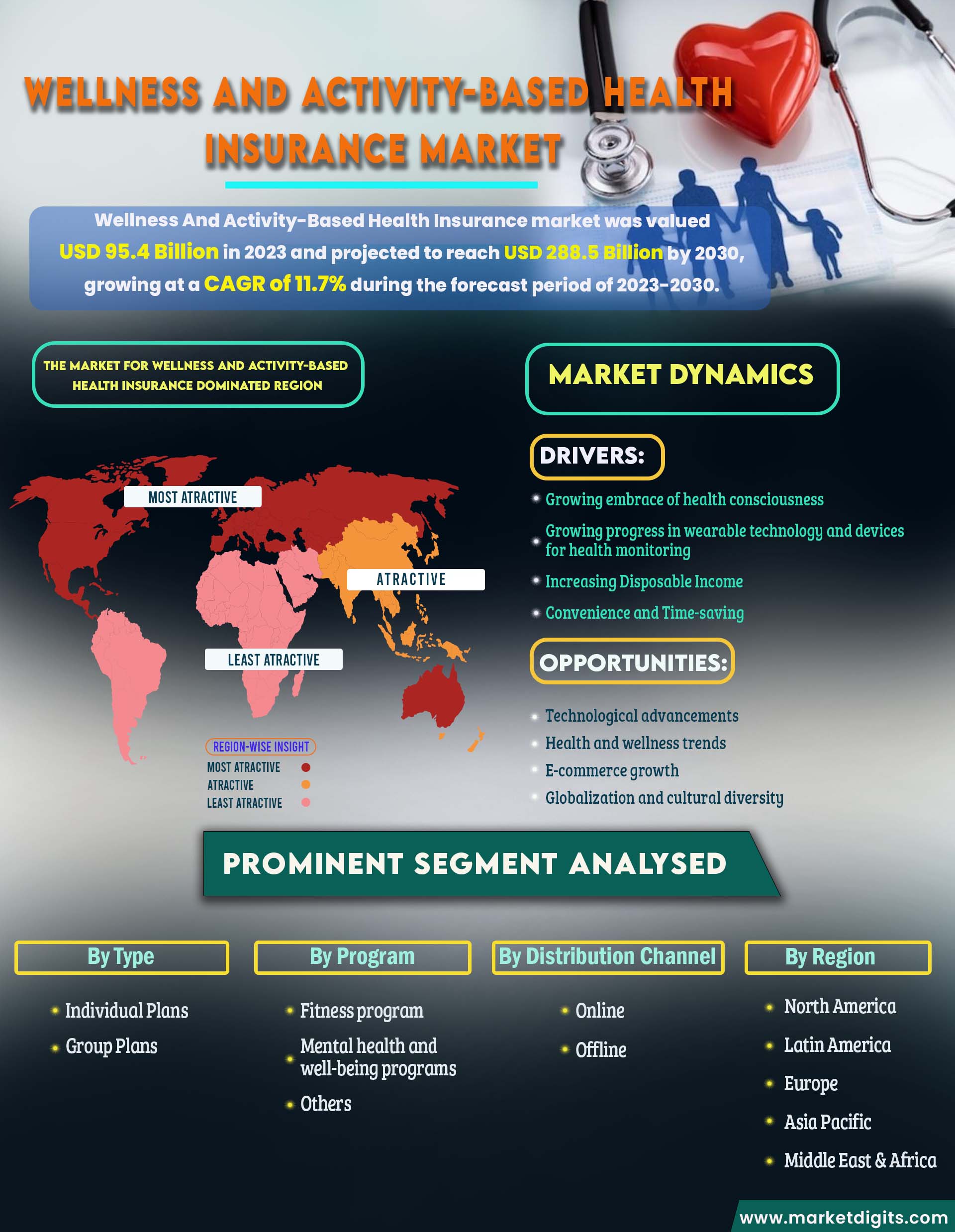

Wellness And Activity-Based Health Insurance Market

Wellness And Activity-Based Health Insurance Market by Type (Individual Plans and Group Plans), Program (Fitness program, Mental health and well-being programs and Others), Service Platform (Insurance companies, Healthcare providers and Others), Distribution Channel and Region - Partner & Customer Ecosystem (Product Services, Proposition & Key Features) Competitive Index & Regional Footprints by MarketDigits - Forecast 2024-2032

Industry : Healthcare | Pages : 183 Pages | Published On : Apr 2024

Market Overview

The wellness and activity-based health insurance market is experiencing growth and gaining prominence. These types of insurance plans are designed to encourage and reward policy holders for adopting healthier lifestyles and engaging in various wellness activities. The market overview typically highlighted the increasing awareness of health and wellness among individuals, leading to a demand for insurance products that go beyond traditional coverage. Activity-based health insurance often involves policyholders participating in wellness programs, fitness activities, and adopting healthier habits to earn benefits such as premium discounts, cash rewards, or other incentives.

The growth of this market was driven by a shift in consumer preferences toward proactive health management and preventive measures. Insurance companies were leveraging technology and data analytics to track policyholders' activities and reward them for maintaining a healthy lifestyle. Top key players are Cigna Corporation, Humana Inc, Kaiser Permanente Center for Health Research, Niva Bupa Health Insurance Company Limited, Oscar Health and others.

Major vendors in the global Wellness and Activity-Based Health Insurance market: Aetna Inc, Anthem, Inc, Bajaj Allianz Health Insurance, Bharti AXA Life Insurance, Blue Cross Blue Shield Association, Cigna Corporation, Humana Inc, Kaiser Permanente Center for Health Research, Niva Bupa Health Insurance Company Limited, Oscar Health, UNITED HEALTH GROUP., Virgin, Vitality Group International, Inc. and Others.

Growing progress in wearable technology and devices for health monitoring

The Wellness and Activity-Based Health Insurance Market is witnessing a substantial upswing, largely fueled by the growing progress in wearable technology and health monitoring devices. With the increasing prevalence of health-conscious individuals seeking proactive approaches to well-being, insurance providers are incorporating innovative strategies to incentivize policyholders for adopting healthier lifestyles. Wearable devices, such as fitness trackers and smartwatches, play a pivotal role in this trend by enabling real-time monitoring of physical activities, sleep patterns, and other health metrics. Insurance companies are leveraging the data generated by these wearables to tailor activity-based health insurance plans. Policyholders who actively engage in wellness programs, regular exercise, and other health-promoting activities are rewarded with premium discounts, cash incentives, or additional coverage benefits. This symbiotic relationship between technology and insurance not only encourages individuals to prioritize their health but also allows insurers to promote preventive healthcare measures, ultimately contributing to the overall well-being of policyholders. As wearable technology continues to advance, providing more accurate and comprehensive health data, the synergy between technology-driven health monitoring and innovative insurance solutions is expected to further propel the growth of the Wellness and Activity-Based Health Insurance Market in the coming years.

Market Dynamics

Drivers:

- Growing embrace of health consciousness

- Growing progress in wearable technology and devices for health monitoring

- Increasing Disposable Income

- Convenience and Time-saving

Opportunities:

- Technological advancements

- Health and wellness trends

- E-commerce growth

- Globalization and cultural diversity

Advancements in Wellness Processing Technologies

Technological advancements are reshaping the landscape of the Wellness and Activity-Based Health Insurance Market, offering transformative opportunities for both insurers and policyholders. With the integration of cutting-edge technologies, such as artificial intelligence, data analytics, and Internet of Things (IoT), insurance providers can gather and analyze a wealth of health-related data in real time. Wearable devices, mobile apps, and smart sensors enable policyholders to monitor their physical activities, track vital signs, and maintain a comprehensive record of their well-being. This influx of health data allows insurance companies to create personalized and dynamic wellness programs. Insurers can tailor coverage and incentives based on individual health metrics, encouraging policyholders to adopt healthier lifestyles. Moreover, technological advancements enhance the accuracy of risk assessments, enabling insurers to develop more precise pricing models and customized policies. For policyholders, technology-driven wellness initiatives not only offer financial benefits through reduced premiums or incentives but also empower them with greater control over their health outcomes. As technology continues to evolve, fostering a seamless connection between health monitoring tools and insurance solutions, the Wellness and Activity-Based Health Insurance Market is poised to witness sustained growth, providing a win-win scenario for both insurers and those seeking proactive health management.

North America dominates the market for Wellness and activity-based health insurance.

North America stands out as the dominating region in the global Wellness and Activity-Based Health Insurance market, with the United States leading in consumption and market share. This phenomenon can be attributed to the increase in income levels and longer life expectancies. The U.S. market particularly benefits from a diverse consumer base with a penchant for quick and convenient health and well-being options.

Asia-Pacific, and specifically India, is emerging as a key player with substantial growth potential in the Wellness and Activity-Based Health Insurance market. Anticipated growth during the forecast period is attributed to heightened consumer awareness, with major market players strategically targeting developing countries in the Asia-Pacific region. Additionally, government initiatives promoting the well-being processing sector and improvements in distribution channels contribute to the market's growth.

Another noteworthy region is the Middle East and Africa, where the demand for convenient health and well-being solutions is on the rise due to changing lifestyles and an expanding working-class population. South Africa, in particular, showcases promise as a market with high growth potential, driven by urbanization and a growing awareness of convenient health and well-being options.

The Fitness program Segments is anticipated to hold the Largest Market Share during the Forecast Period

In the realm of the Wellness and Activity-Based Health Insurance Market, fitness programs have emerged as integral components, shaping a paradigm shift towards preventive healthcare. Insurance providers are increasingly incorporating fitness initiatives into their offerings, encouraging policyholders to actively engage in health and wellness activities. These fitness programs often involve personalized workout routines, nutritional guidance, and access to fitness classes or facilities. Policyholders who participate in these fitness programs stand to gain various incentives within the activity-based insurance framework. These incentives may include premium discounts, cash rewards, or additional coverage benefits, fostering a mutually beneficial relationship between insurers and policyholders. The integration of fitness programs not only promotes physical well-being but also aligns with broader health and wellness objectives. Moreover, the incorporation of technology, such as wearable devices and mobile apps, enhances the effectiveness of these fitness programs by providing real-time tracking of activities and health metrics. As the Wellness and Activity-Based Health Insurance Market continues to evolve, fitness programs serve as catalysts for positive life changes, incentivizing individuals to prioritize their health while redefining the insurance landscape towards a more proactive and preventive healthcare model.

Segmentations Analysis of Wellness and Activity-Based Health Insurance Market: -

- By Type

- Individual Plans

- Group Plans

- By Program

- Fitness program

- Mental health and well-being programs

- Others

- By Service provider

- Insurance companies

- Healthcare providers

- Others

- By Distribution Channel

- Online

- Offline

- By Region

- North America

- US

- Canada

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Rest of Latin America

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- BENELUX

- CIS & Russia

- Nordics

- Austria

- Poland

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Indonesia

- Malaysia

- Vietnam

- Australia & New Zealand

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Nigeria

- Egypt

- Israel

- Turkey

- Rest of Middle East & Africa

- North America

Recent Developments

- In February 2024, Sapiens International Corporation entered into a partnership with Binah.ai, This partnership enabled Binah.ai to leverage Sapiens’ strong global presence and provide Sapiens’ customers with seamless access to Binah.ai’s software-based health and wellness check technology.

- In October 2022, Tata AIA Life Insurance had launched a new wellness program called TATA AIA Vitality, enhancing their range of life insurance offerings

Wellness And Activity-Based Health Insurance Market Report Gives Answers to Following Key Questions:

- What will be the Wellness and Activity-Based Health Insurance Market’s Trends & growth rate? What analysis has been done of the prices, sales, and volume of the top producers of Wellness And Activity-Based Health Insurance Market?

- What are the main forces behind the worldwide Wellness and Activity-Based Health Insurance Market? Which companies dominate the Wellness and Activity-Based Health Insurance Market?

- Which companies dominate the Wellness and Activity-Based Health Insurance Market? Which business possibilities, dangers, and tactics did they embrace in the market?

- What are the global Wellness and Activity-Based Health Insurance industry's suppliers' opportunities and dangers in Wellness and Activity-Based Health Insurance Market?

- What is the Wellness and Activity-Based Health Insurance industry's regional sales, income, and pricing analysis? In the Wellness and Activity-Based Health Insurance Market, who are the distributors, traders, and resellers?

- What are the main geographic areas for various trades that are anticipated to have astounding expansion over the Wellness and Activity-Based Health Insurance Market?

- What are the main geographical areas for various industries that are anticipated to observe an astounding expansion in Wellness and Activity-Based Health Insurance Market?

- What is the dominant revenue-generating regions for Wellness and Activity-Based Health Insurance Market, as well as regional growth trends?

- By the end of the forecast period, what will the market size and growth rate be?

- What are the main Wellness and Activity-Based Health Insurance Market trends that are influencing the market's expansion?

- Which key product categories dominate the Wellness and Activity-Based Health Insurance Market? What are the Wellness and Activity-Based Health Insurance Market’s main applications?

- In the coming years, which Wellness and Activity-Based Health Insurance Market technology will dominate the market?

Reason to purchase this Wellness And Activity-Based Health Insurance Market Report:

- Determine prospective investment areas based on a detailed trend analysis of the global Wellness And Activity-Based Health Insurance Market over the next years.

- Gain an in-depth understanding of the underlying factors driving demand for different Wellness And Activity-Based Health Insurance Market segments in the top spending countries across the world and identify the opportunities each offers.

- Strengthen your understanding of the market in terms of demand drivers, industry trends, and the latest technological developments, among others.

- Identify the major channels that are driving the global Wellness And Activity-Based Health Insurance Market, providing a clear picture of future opportunities that can be tapped, resulting in revenue expansion.

- Channelize resources by focusing on the ongoing programs that are being undertaken by the different countries within the global Wellness And Activity-Based Health Insurance Market.

- Make correct business decisions based on a thorough analysis of the total competitive landscape of the sector with detailed profiles of the top Wellness And Activity-Based Health Insurance Market providers worldwide, including information about their products, alliances, recent contract wins, and financial analysis wherever available.

Cloud Engineering Market Size, Share & Trends Analysis, By Deployment (Public, Private, Hybrid), By Service (IaaS, PaaS, SaaS), By Workload, By Enterprise Size By End-use, By Region, And Segment Forecasts

TOC

Table and Figures

Methodology:

At MarketDigits, we take immense pride in our 360° Research Methodology, which serves as the cornerstone of our research process. It represents a rigorous and comprehensive approach that goes beyond traditional methods to provide a holistic understanding of industry dynamics.

This methodology is built upon the integration of all seven research methodologies developed by MarketDigits, a renowned global research and consulting firm. By leveraging the collective strength of these methodologies, we are able to deliver a 360° view of the challenges, trends, and issues impacting your industry.

The first step of our 360° Research Methodology™ involves conducting extensive primary research, which involves gathering first-hand information through interviews, surveys, and interactions with industry experts, key stakeholders, and market participants. This approach enables us to gather valuable insights and perspectives directly from the source.

Secondary research is another crucial component of our methodology. It involves a deep dive into various data sources, including industry reports, market databases, scholarly articles, and regulatory documents. This helps us gather a wide range of information, validate findings, and provide a comprehensive understanding of the industry landscape.

Furthermore, our methodology incorporates technology-based research techniques, such as data mining, text analytics, and predictive modelling, to uncover hidden patterns, correlations, and trends within the data. This data-driven approach enhances the accuracy and reliability of our analysis, enabling us to make informed and actionable recommendations.

In addition, our analysts bring their industry expertise and domain knowledge to bear on the research process. Their deep understanding of market dynamics, emerging trends, and future prospects allows for insightful interpretation of the data and identification of strategic opportunities.

To ensure the highest level of quality and reliability, our research process undergoes rigorous validation and verification. This includes cross-referencing and triangulation of data from multiple sources, as well as peer reviews and expert consultations.

The result of our 360° Research Methodology is a comprehensive and robust research report that empowers you to make well-informed business decisions. It provides a panoramic view of the industry landscape, helping you navigate challenges, seize opportunities, and stay ahead of the competition.

In summary, our 360° Research Methodology is designed to provide you with a deep understanding of your industry by integrating various research techniques, industry expertise, and data-driven analysis. It ensures that every business decision you make is based on a well-triangulated and comprehensive research experience.

• Product Planning Strategy

• New Product Stratergy

• Expanded Research Scope

• Comprehensive Research

• Strategic Consulting

• Provocative and pragmatic

• Accelerate Revenue & Growth

• Evaluate the competitive landscape

• Optimize your partner network

• Analyzing industries

• Mapping trends

• Strategizing growth

• Implementing plans

Covered Key Topics

Growth Opportunities

Market Growth Drivers

Leading Market Players

Company Market Share

Market Size and Growth Rate

Market Trend and Technological

Research Assistance

We will be happy to help you find what you need. Please call us or write to us:

+1 510-730-3200 (USA Number)

Email: sales@marketdigits.com