- Home

- Information Technology

-

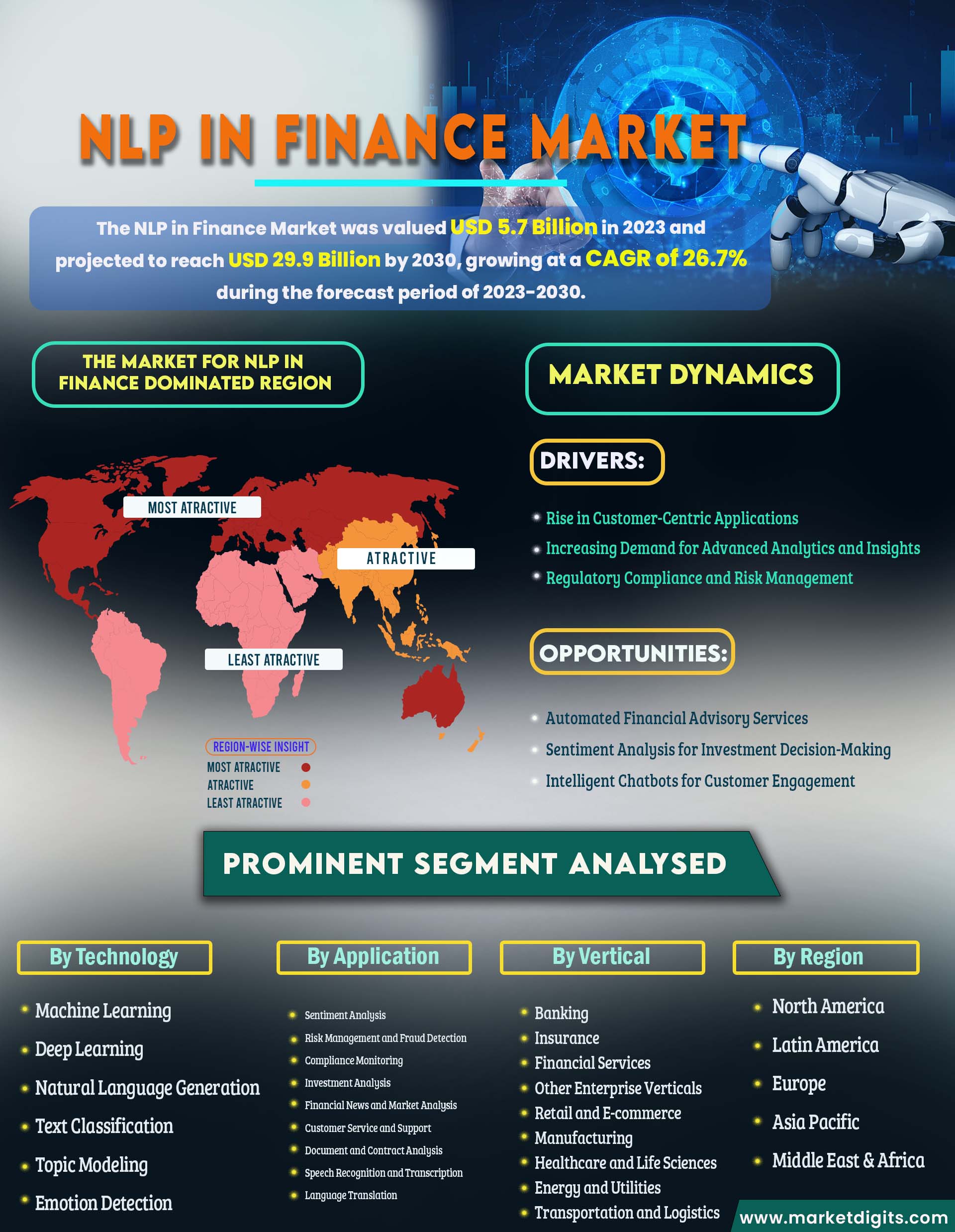

NLP in Finance Market

NLP in Finance Market , by offerings, hybrid NLP software, by technology, by applications, by verticals and Region - Partner & Customer Ecosystem (Product Services, Proposition & Key Features) Competitive Index & Regional Footprints by MarketDigits - Forecast 2024-2032

Industry : Information Technology | Pages : 182 Pages | Published On : May 2024

Market Overview

The Natural Language Processing (NLP) market is experiencing significant growth and evolution, driven by the increasing demand for advanced language-based technologies across diverse industries. NLP, a branch of artificial intelligence (AI) that focuses on the interaction between computers and human languages, has become a pivotal component in various applications, ranging from customer service and sentiment analysis to chatbots and language translation. The key driver of the NLP market is the growing volume of unstructured data, including text and speech, generated by businesses and individuals. As organizations seek to derive meaningful insights from this vast amount of information, the adoption of NLP solutions has surged. The ability of NLP to comprehend, interpret, and generate human-like language has made it an invaluable tool for automating tasks, improving user experiences, and enhancing decision-making processes. Furthermore, industries such as healthcare, finance, and e-commerce are increasingly leveraging NLP applications to streamline operations and provide more personalized services. In healthcare, for instance, NLP is employed for clinical documentation, diagnostics, and patient engagement. In finance, it aids in sentiment analysis for trading decisions and risk management. E-commerce platforms use NLP for recommendation engines and customer support. As the demand for more sophisticated language processing capabilities continues to rise, the NLP market is expected to witness sustained growth. However, challenges such as language diversity, privacy concerns, and ethical considerations also pose considerations for industry stakeholders. Nevertheless, the overall outlook for the NLP market remains optimistic, with ongoing research and development efforts driving continuous improvements in language processing technologies.

Major vendors in the global NLP in Finance Market are Microsoft, IBM, Google, AWS, Oracle, SAS Institute, Qualtrics, Baidu, Inbenta, Basis Technology, Nuance Communications, expert.ai, LivePerson, Veritone, Automated Insights, Bitext, Conversica, Accern, Kasisto, Kensho, ABBYY, Mosaic, Uniphore, Observe.AI, Lilt, Cognigy, Addepto, Skit.ai, MindTitan, Supertext.ai, Narrativa, and Cresta and Others.

Increasing Demand for Advanced Analytics and Insights

The primary drivers propelling the Global Natural Language Processing (NLP) in Finance Market is the escalating demand for advanced analytics and insights derived from the vast and ever-growing volume of financial data. Financial institutions are grappling with the challenge of managing and extracting meaningful information from complex datasets that include market trends, customer behavior, and economic indicators. NLP, with its ability to comprehend and analyze unstructured data from various sources, offers a powerful solution. By employing NLP algorithms, financial organizations can efficiently process textual data from news articles, social media, financial reports, and other textual sources. This capability allows them to uncover hidden patterns, sentiment analysis, and emerging market trends, empowering decision-makers with timely and relevant information to make informed investment decisions, manage risks, and optimize financial strategies. As financial markets become increasingly dynamic and interconnected, the demand for NLP-driven advanced analytics continues to surge, driving the growth of the market.

Market Dynamics

Drivers:

- Rise in Customer-Centric Applications

- Increasing Demand for Advanced Analytics and Insights

- Regulatory Compliance and Risk Management

Opportunities:

- Automated Financial Advisory Services

- Sentiment Analysis for Investment Decision-Making

- Intelligent Chatbots for Customer Engagement

Intelligent Chatbots for Customer Engagement

A significant market opportunity for NLP in the finance industry lies in the development of intelligent chatbots for customer engagement. NLP-driven chatbots can revolutionize customer interactions by providing instant, accurate, and contextually relevant responses to queries related to account information, transaction history, and financial products. These chatbots not only enhance the customer experience by offering seamless communication but also contribute to operational efficiency by automating routine tasks. The opportunity here is to deploy chatbots that not only understand natural language but also possess the capability to navigate complex financial queries, guide users through transactions, and even educate customers about various financial products and services. As customer expectations for real-time support and personalized interactions continue to rise, NLP-driven chatbots present a strategic opportunity for financial institutions to improve customer satisfaction, reduce service costs, and strengthen customer loyalty.

The market for NLP in Finance is dominated by North America.

In 2023, North America is set to assume a leading role in the NLP in Finance market, and the United States is expected to maintain its dominance in the region, a trend foreseen to endure until 2030. The dominance of North America in the Global Natural Language Processing (NLP) in Finance Market is underpinned by the region's advanced technological infrastructure, a high level of digitalization in financial services, and a proactive stance toward innovation. Particularly noteworthy is the substantial contribution of the United States, where leading financial institutions are actively embracing NLP solutions for a spectrum of tasks, including customer service automation and risk management. Regulatory initiatives advocating for the integration of advanced technologies in the financial sector further propel the market's growth. The robust ecosystem comprising technology providers, research institutions, and financial enterprises solidifies North America's position as a pivotal hub for driving NLP advancements in the finance sector.

The Asia-Pacific region is emerging as a key player in the Global NLP in Finance Market, driven by rapid economic growth, increasing digitalization of financial services, and a growing emphasis on technological innovation. Countries like China, Japan, and Singapore are witnessing a surge in the adoption of NLP solutions by financial institutions seeking to improve customer engagement, automate processes, and gain a competitive edge. The region's diverse financial ecosystems, coupled with a strong presence of tech-savvy consumers, create a fertile ground for NLP applications. Regulatory support and government initiatives aimed at fostering fintech innovation further contribute to the expanding influence of the Asia-Pacific region in shaping the future of NLP in finance.

The technology segment is anticipated to hold the largest market share during the forecast period

The technology segment is divided into machine learning, deep learning, natural language generation, text classification, topic modeling, emotion detection and other technologies. In 2022, the technology segment is anticipated to hold the largest market share during the forecast period. The market is poised for ongoing rapid expansion owing to the surging demand for Natural Language Processing (NLP) tools within the finance sector. The incorporation of machine learning algorithms into NLP has markedly enhanced the precision and effectiveness of solutions tailored for finance. NLP tools based on machine learning exhibit the capability to process extensive datasets, delivering insights that are both more accurate and personalized. The adoption of chatbots and virtual assistants, driven by NLP, is gaining traction within financial institutions. These innovative tools offer customers personalized financial guidance and assistance, resulting in an enhancement of customer engagement and overall satisfaction. This trajectory underscores the growing significance of NLP tools, particularly those integrating machine learning algorithms, as indispensable components in meeting the evolving needs of the finance industry for advanced and efficient language processing solutions.

Major Segmentations Are Distributed as follows:

- By Offering:

- Software

- Rule-based NLP Software

- Regular Expression (Regex)

- Finite State Machines (FSMs)

- Named Entity Recognition (NER)

- Part-of-speech (POS) Tagging

- Statistical NLP Software

- Naive Bayes

- Logistic Regression

- Support Vector Machines (SVMs)

- Recurrent Neural Networks (RNNs)

- Hybrid NLP software

- Latent Dirichlet Allocation (LDA)

- Hidden Markov Models (HMMs)

- Conditional Random Fields (CRFs)

- Services

- Professional Services

- Training and Consulting

- System Integration and Implementation

- Support and Maintenance

- Managed Services

- By Technology:

- Machine Learning

- Supervised Learning

- Unsupervised Learning

- Reinforcement Learning

- Deep Learning

- Convolutional Neural Networks (CNN)

- Recurrent Neural Networks (RNN)

- Transformer Models (BERT, GPT-3, etc.)

- Natural Language Generation

- Automated Report Writing

- Customer Communication

- Financial Document Generation

- Text Classification

- Sentiment Classification

- Intent Classification

- Topic Modeling

- Topic Identification

- Topic Clustering

- Topic Visualization

- Emotion Detection

- Emotion Recognition

- Emotion Classification

- Machine Learning

- Other Technologies

- By Application:

- Sentiment Analysis

- Brand Reputation Management

- Market Sentiment Analysis

- Customer Feedback Analysis

- Product Review Analysis

- Social Media Monitoring

- Risk Management and Fraud Detection

- Credit Risk Assessment

- Fraud Detection and Prevention

- Anti-money laundering (AML)

- Compliance Monitoring

- Cybersecurity and Threat Detection

- Compliance Monitoring

- Regulatory Compliance Monitoring

- KYC/AML Compliance Monitoring

- Legal and Policy Compliance Monitoring

- Audit Trail Monitoring

- Trade Surveillance

- Investment Analysis

- Asset Allocation and Portfolio Optimization

- Equity Research and Analysis

- Quantitative Analysis and Modeling

- Investment Recommendations and Planning

- Risk Management and Prediction

- Investment Opportunity Identification

- Financial News and Market Analysis

- Financial News and Analysis

- Stock Market Prediction

- Macroeconomic Analysis

- Customer Service and Support

- Chatbots and Virtual Assistants

- Personalized Support and Service

- Complaint Resolution

- Query Resolution and Escalation Management

- Self-service Options

- Document and Contract Analysis

- Contract Management

- Legal Document Analysis

- Due Diligence Analysis

- Data Extraction and Normalization

- Speech Recognition and Transcription

- Voice-enabled Search and Navigation

- Speech-to-Text Conversion

- Call Transcription and Analysis

- Voice Biometrics and Authentication

- Speech-enabled Virtual Assistants

- Language Translation

- Financial Document Translation

- Investment Research Translation

- Multilingual Customer Service and Support

- Cross-border Business Communication

- Localization and Internationalization

- Other Applications (CRM Optimization, Underwriting Assistance)

- Sentiment Analysis

- By Vertical:

- Banking

- Retail Banking

- Corporate Banking

- Investment Banking

- Wealth Management

- Insurance

- Life Insurance

- Property and Casualty Insurance

- Health Insurance

- Financial Services

- Credit rating

- Payment Processing and Remittance

- Accounting and Auditing

- Personal Finance Management

- Robo-advisory

- Cryptocurrencies and Blockchain

- Stock Movement Prediction

- Other Enterprise Verticals

- Retail and E-commerce

- Manufacturing

- Healthcare and Life Sciences

- Energy and Utilities

- Transportation and Logistics

- Banking

- By Region

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Rest of Latin America

- Europe

- Germany

- France

- Italy

- Spain

- U.K.

- BENELUX

- CIS & Russia

- Nordics

- Austria

- Poland

- Rest of Europe

- Asia Pacific

- North America

-

- China

- Japan

- South Korea

- India

- Thailand

- Indonesia

- Malaysia

- Vietnam

- Australia & New Zealand

- Rest of Asia Pacific

-

- Middle East & Africa

-

- Saudi Arabia

- UAE

- South Africa

- Nigeria

- Egypt

- Israel

- Turkey

- Rest of MEA

Recent Developments

- In December 2022, AWS has revealed that Stability AI, an open-source artificial intelligence (AI) company driven by community collaboration, has chosen AWS as its favored cloud provider to develop and expand its AI models. This selection is specifically for image, language, audio, video, and 3D content generation purposes.

- In April 2022, Microsoft has declared its acquisition of Nuance Communications, a prominent player in conversational AI and ambient intelligence spanning various industries such as healthcare, financial services, retail, and telecommunications. With a mutual vision of constructing AI solutions based on outcomes, Microsoft and Nuance aim to empower organizations in diverse sectors to expedite the achievement of their business objectives.

Answers to Following Key Questions:

- What will be the NLP in Finance Market’s Trends & growth rate? What analysis has been done of the prices, sales, and volume of the top producers in the NLP in Finance Market?

- What are the main forces behind worldwide NLP in Finance Market? Which companies dominate NLP in Finance Market?

- Which companies dominate NLP in Finance Market? Which business possibilities, dangers, and tactics did they embrace in the market?

- What are the global NLP in Finance industry's suppliers' opportunities and dangers in NLP in Finance Market?

- What is the NLP in Finance industry's regional sales, income, and pricing analysis? In the NLP in Finance Market, who are the distributors, traders, and resellers?

- What are the main geographic areas for various trades that are anticipated to have astounding expansion over the NLP in Finance Market?

- What are the main geographical areas for various industries that are anticipated to observe astounding expansion for NLP in Finance Market?

- What are the dominant revenue-generating regions for NLP in Finance Market, as well as regional growth trends?

- By the end of the forecast period, what will the market size and growth rate be?

- What are the main NLP in Finance Market trends that are influencing the market's expansion?

- Which key product categories dominate NLP in Finance Market? What is NLP in Finance Market’s main applications?

- In the coming years, which NLP in Finance Market technology will dominate the market?

Reason to purchase this NLP in Finance Market Report:

- Determine prospective investment areas based on a detailed trend analysis of the global NLP in Finance Market over the next years.

- Gain an in-depth understanding of the underlying factors driving demand for different NLP in Finance Market segments in the top spending countries across the world and identify the opportunities each offers.

- Strengthen your understanding of the market in terms of demand drivers, industry trends, and the latest technological developments, among others.

- Identify the major channels that are driving the global NLP in Finance Market , providing a clear picture of future opportunities that can be tapped, resulting in revenue expansion.

- Channelize resources by focusing on the ongoing programs that are being undertaken by the different countries within the global NLP in Finance Market.

- Make correct business decisions based on a thorough analysis of the total competitive landscape of the sector with detailed profiles of the top NLP in Finance Market providers worldwide, including information about their products, alliances, recent contract wins, and financial analysis wherever available.

Cloud Engineering Market Size, Share & Trends Analysis, By Deployment (Public, Private, Hybrid), By Service (IaaS, PaaS, SaaS), By Workload, By Enterprise Size By End-use, By Region, And Segment Forecasts

TOC

Table and Figures

Methodology:

At MarketDigits, we take immense pride in our 360° Research Methodology, which serves as the cornerstone of our research process. It represents a rigorous and comprehensive approach that goes beyond traditional methods to provide a holistic understanding of industry dynamics.

This methodology is built upon the integration of all seven research methodologies developed by MarketDigits, a renowned global research and consulting firm. By leveraging the collective strength of these methodologies, we are able to deliver a 360° view of the challenges, trends, and issues impacting your industry.

The first step of our 360° Research Methodology™ involves conducting extensive primary research, which involves gathering first-hand information through interviews, surveys, and interactions with industry experts, key stakeholders, and market participants. This approach enables us to gather valuable insights and perspectives directly from the source.

Secondary research is another crucial component of our methodology. It involves a deep dive into various data sources, including industry reports, market databases, scholarly articles, and regulatory documents. This helps us gather a wide range of information, validate findings, and provide a comprehensive understanding of the industry landscape.

Furthermore, our methodology incorporates technology-based research techniques, such as data mining, text analytics, and predictive modelling, to uncover hidden patterns, correlations, and trends within the data. This data-driven approach enhances the accuracy and reliability of our analysis, enabling us to make informed and actionable recommendations.

In addition, our analysts bring their industry expertise and domain knowledge to bear on the research process. Their deep understanding of market dynamics, emerging trends, and future prospects allows for insightful interpretation of the data and identification of strategic opportunities.

To ensure the highest level of quality and reliability, our research process undergoes rigorous validation and verification. This includes cross-referencing and triangulation of data from multiple sources, as well as peer reviews and expert consultations.

The result of our 360° Research Methodology is a comprehensive and robust research report that empowers you to make well-informed business decisions. It provides a panoramic view of the industry landscape, helping you navigate challenges, seize opportunities, and stay ahead of the competition.

In summary, our 360° Research Methodology is designed to provide you with a deep understanding of your industry by integrating various research techniques, industry expertise, and data-driven analysis. It ensures that every business decision you make is based on a well-triangulated and comprehensive research experience.

• Product Planning Strategy

• New Product Stratergy

• Expanded Research Scope

• Comprehensive Research

• Strategic Consulting

• Provocative and pragmatic

• Accelerate Revenue & Growth

• Evaluate the competitive landscape

• Optimize your partner network

• Analyzing industries

• Mapping trends

• Strategizing growth

• Implementing plans

Covered Key Topics

Growth Opportunities

Market Growth Drivers

Leading Market Players

Company Market Share

Market Size and Growth Rate

Market Trend and Technological

Research Assistance

We will be happy to help you find what you need. Please call us or write to us:

+1 510-730-3200 (USA Number)

Email: sales@marketdigits.com