Food Robotics Market By Type (Articulated, Cartesian, Scara, Parallel, Cylindrical, Collaborative, Other), Payload (High, Medium, Low), Function (Palletizing, Packaging, Repackaging, Picking, Processing, Other), Application (Meat, Poultry, & Seafood, Processed Food, Dairy Products, Fruits & Vegetables, Beverage, Bakery & Confectionery Products, Other) and Region - Partner & Customer Ecosystem (Product Services, Proposition & Key Features) Competitive Index & Regional Footprints by MarketDigits - Forecast 2024-2032

Industry : FMCG | Pages : 180 Pages | Published On : Apr 2024

The global food robotics market plays a pivotal role in transforming the food industry by integrating advanced robotic technologies into various processes, from production to packaging. This market is driven by the need for increased efficiency, precision, and automation in food manufacturing, addressing challenges such as labor shortages and the demand for higher production volumes. Food robotics contribute significantly to improving operational efficiency, reducing production costs, and enhancing overall product quality and safety. With robots handling tasks such as sorting, cutting, packaging, and quality control, the industry experiences streamlined processes, minimized waste, and improved consistency in food production. The implementation of robotics also aligns with the growing focus on sustainability, as it enables more precise resource utilization and reduces environmental impact in the food production ecosystem.

Furthermore, the food robotics market fosters innovation in the industry by supporting the development of intelligent and adaptable robotic systems. These systems can be customized to meet specific requirements, allowing food manufacturers to stay agile in response to changing consumer preferences and market trends. As the industry continues to evolve, the adoption of food robotics is expected to play a crucial role in ensuring a resilient and competitive food production ecosystem, ultimately benefiting both manufacturers and consumers alike.

Major vendors in the global Food Robotics market : ABB Group, KUKA AG, Fanuc Corporation, Kawasaki Heavy Industries Ltd., Rockwell Automation Inc., Mitsubishi Electric Corporation, Yasakawa Electric Corporation, Denso Corporation, Nachi-Fujikoshi Corporation, OMRON Corporation, Universal Robots A/S, Staubli International AG, Bastian Solutions LLC, Schunk GmbH, Asic Robotics AG, Mayekawa Mfg. Co. Ltd., Apex Automation & Robotics, Aurotek Corporation, Ellison Technologies Inc., Fuji Robotics, Moley Robotics, and Others.

Increasing Demand for Food Safety and Quality

In recent years, the global food industry has witnessed a growing emphasis on food safety and quality. Consumers are becoming more conscious of the origin, processing, and handling of food products. Foodborne illnesses and contamination incidents have raised concerns, prompting stricter regulations and standards across the supply chain. To address these challenges, the food industry is increasingly turning to robotics for its precision and efficiency in maintaining hygiene and quality throughout the production process. Robots equipped with sensors and vision systems can detect defects, contaminants, and irregularities in food items, ensuring that only high-quality products reach consumers. Automation also reduces the risk of human errors and minimizes the chances of cross-contamination, making it a crucial driver for the adoption of robotics in the global food industry.

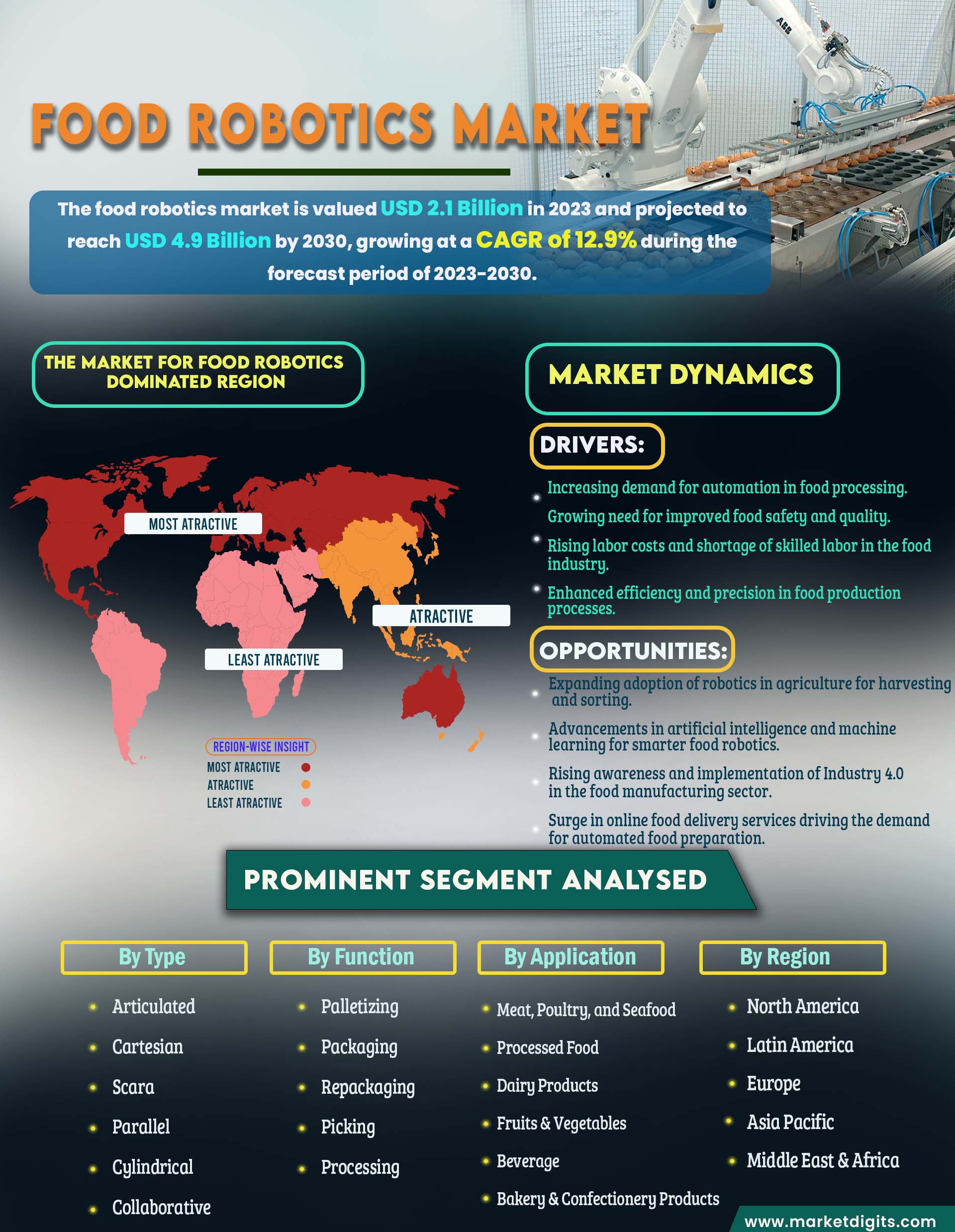

Market Dynamics

Drivers:

- Increasing demand for automation in food processing.

- Growing need for improved food safety and quality.

- Rising labor costs and shortage of skilled labor in the food industry.

- Enhanced efficiency and precision in food production processes.

Opportunities:

- Expanding adoption of robotics in agriculture for harvesting and sorting.

- Advancements in artificial intelligence and machine learning for smarter food robotics.

- Rising awareness and implementation of Industry 4.0 in the food manufacturing sector.

- Surge in online food delivery services driving the demand for automated food preparation.

Labor Shortages and Rising Labor Costs

The global food industry is facing a shortage of skilled labor, especially in tasks that involve repetitive and physically demanding work. Additionally, labor costs are on the rise in various parts of the world. In response to these challenges, food manufacturers are turning to automation and robotics to streamline their production processes and minimize dependence on manual labor. Robotic systems, including pick-and-place robots, packaging robots, and palletizing robots, can perform tasks with high speed and precision, contributing to increased efficiency and reduced operational costs. The integration of robotic solutions not only addresses the labor shortage issue but also enhances overall productivity and operational flexibility in the food manufacturing sector.

North America dominates the market for Food Robotics.

The dominating region in the global food robotics market is North America, with the United States being the key player. The region's dominance is attributed to the presence of established food processing industries, a high level of automation adoption, and significant investments in research and development. The United States, with its advanced manufacturing infrastructure and technology-driven approach, leads in the implementation of robotic solutions across various stages of food production.

Looking ahead, Asia-Pacific is emerging as a region with high growth potential in the food robotics market. China, in particular, is witnessing a surge in demand for robotics in the food industry. The country's rapidly growing population, coupled with an increasing focus on food safety and quality, is driving the adoption of robotic technologies. Additionally, the government's initiatives to promote automation in manufacturing processes contribute to the region's potential for growth in the food robotics market. As food production in Asia-Pacific continues to expand, countries like India and Japan are also expected to experience a rising demand for robotics in the food sector, driven by the need for enhanced efficiency and quality control in food processing.

The Type Segments is anticipated to hold the Largest Market Share during the Forecast Period

The global food robotics market is categorized into various segments, the type segment includes articulated, cartesian, scara, parallel, cylindrical, collaborative, and other types. Among these, collaborative robots (cobots) have emerged as the dominating segment. Their dominance is attributed to their unique ability to work seamlessly alongside human operators, enhancing efficiency and flexibility in food processing. Collaborative robots are designed to collaborate with human workers in a shared workspace, ensuring safety and optimizing productivity. The collaborative nature of these robots makes them particularly well-suited for the dynamic and complex environments of the food industry, where tasks often require human-level dexterity and adaptability. As food processing increasingly demands a balance between automation and human intervention, collaborative robots play a pivotal role in meeting these evolving industry needs, hence driving their dominance in the global food robotics market.

Segmentations Analysis of Food Robotics Market: -

- By Type

- Articulated

- Cartesian

- Scara

- Parallel

- Cylindrical

- Collaborative

- Other

- By Payload

- High

- Medium

- Low

- By Function

- Palletizing

- Packaging

- Repackaging

- Picking

- Processing

- Other

- By Application

- Meat, Poultry, and Seafood

- Processed Food

- Dairy Products

- Fruits & Vegetables

- Beverage

- Bakery & Confectionery Products

- Other

- By Region

- North America

- US

- Canada

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Rest of Latin America

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- BENELUX

- CIS & Russia

- Nordics

- Austria

- Poland

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Indonesia

- Malaysia

- Vietnam

- Australia & New Zealand

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Nigeria

- Egypt

- Israel

- Turkey

- Rest of Middle East & Africa

- North America

Recent Developments

- In August 2023, Robotics is being used by foodtech startup Cafex Technologies to enhance the food service sector. They have created "Cafex," an advanced, completely automated robotic system that operates autonomously and creates delectable hot and cold beverages inside of a covered kiosk.

Food Robotics Market Report Gives Answers to Following Key Questions:

- What will be the Food Robotics Market’s Trends & growth rate? What analysis has been done of the prices, sales, and volume of the top producers of Food Robotics Market?

- What are the main forces behind the worldwide Food Robotics Market? Which companies dominate the Food Robotics Market?

- Which companies dominate the Food Robotics Market? Which business possibilities, dangers, and tactics did they embrace in the market?

- What are the main geographic areas for various trades that are anticipated to have astounding expansion over the Food Robotics Market?

- What are the main geographical areas for various industries that are anticipated to observe an astounding expansion in Food Robotics Market?

- What are the dominant revenue-generating regions for Food Robotics Market, as well as regional growth trends?

- By the end of the forecast period, what will the market size and growth rate be?

- What are the main Food Robotics Market trends that are influencing the market's expansion?

- Which key product categories dominate the Food Robotics Market? What are the Food Robotics Market’s main applications?

- In the coming years, which Food Robotics Market technology will dominate the market?

Reason to purchase this Food Robotics Market Report:

- Determine prospective investment areas based on a detailed trend analysis of the global Food Robotics Market over the next years.

- Gain an in-depth understanding of the underlying factors driving demand for different Food Robotics Market segments in the top spending countries across the world and identify the opportunities each offers.

- Strengthen your understanding of the market in terms of demand drivers, industry trends, and the latest technological developments, among others.

- Identify the major channels that are driving the global Food Robotics Market, providing a clear picture of future opportunities that can be tapped, resulting in revenue expansion.

- Channelize resources by focusing on the ongoing programs that are being undertaken by the different countries within the global Food Robotics Market.

- Make correct business decisions based on a thorough analysis of the total competitive landscape of the sector with detailed profiles of the top Food Robotics Market providers worldwide, including information about their products, alliances, recent contract wins, and financial analysis wherever available.

Cloud Engineering Market Size, Share & Trends Analysis, By Deployment (Public, Private, Hybrid), By Service (IaaS, PaaS, SaaS), By Workload, By Enterprise Size By End-use, By Region, And Segment Forecasts

TOC

- Executive Summary

- Introduction

- Key Takeaways

- Report Description

- Market Scope & Definition

- Stakeholders

- Research Methodology

- Market size

- Key data points from primary sources

- Key data points from secondary sources

- List of primary sources

- List of secondary sources

- Market Overview

- Introduction

- Industry Segmentation

- Market Trends Analysis

- Major Funding & Investments

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Value Chain Analysis

- Pricing Analysis

- Pricing Analysis, By Products

- Average Pricing Benchmark Analysis

- Food Robotics Market, By Type

-

- Articulated

- Cartesian

- Scara

- Parallel

- Cylindrical

- Collaborative

- Others

-

- Food Robotics Market, By Payload

- High

- Medium

- Low

- Food Robotics Market, By Application

- Palletizing

- Packaging

- Repackaging

- Picking

- Processing

- Others

- Food Robotics Market, By End-User Area

- Meat, poultry, and seafood

- Processed food

- Dairy products

- Fruits & vegetables

- Beverage

- Bakery & confectionery

- Others

- Food Robotics Market, By Geography

- Food Robotics Market, North America

- U.S.

- Canada

- Food Robotics Market, Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Food Robotics Market, Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Food Robotics Market, Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Food Robotics Market, Rest of the world

- Middle East

- UAE

- Saudi Arabia

- Israel

- Africa

- South Africa

- Rest of Africa

- Middle East

- Food Robotics Market, North America

- Competitive Analysis

- Introduction

- Top Companies Ranking

- Competitive Landscape

- Competition Dashboard

- Market Analysis (2022)

- Emerging company case studies

- Company Profiles

- ABB Group (Switzerland)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- KUKA AG (Germany)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- Fanuc Corporation (Japan)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- Kawasaki Heavy Industries Ltd. (Japan)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- Rockwell Automation Inc. (U.S.)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- Mitsubishi Electric Corporation (Japan)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- Yasakawa Electric Corporation (Japan)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- Denso Corporation (Japan)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- Nachi-Fujikoshi Corporation (Japan)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- OMRON Corporation (Japan)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- Universal Robots A/S (Denmark)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- Staubli International AG (Switzerland)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- Bastian Solutions LLC (U.S.)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- Schunk GmbH (Germany)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- Asic Robotics AG (Switzerland)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- Mayekawa Mfg. Co. Ltd. (Japan)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- Apex Automation & Robotics (Australia)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- Aurotek Corporation (Taiwan)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- Ellison Technologies Inc. (U.S.)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- Fuji Robotics (Japan)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- Moley Robotics (U.K.)

- Business Overview

- Product Portfolio

- Market Segments (Business Segment/Region)

- Sales Footprint

- Recent Developments

- New Product Launch

- Mergers & Acquisitions

- Collaborations, Partnerships & Agreements

- Rewards & Recognition

- ABB Group (Switzerland)

Table and Figures

Methodology:

At MarketDigits, we take immense pride in our 360° Research Methodology, which serves as the cornerstone of our research process. It represents a rigorous and comprehensive approach that goes beyond traditional methods to provide a holistic understanding of industry dynamics.

This methodology is built upon the integration of all seven research methodologies developed by MarketDigits, a renowned global research and consulting firm. By leveraging the collective strength of these methodologies, we are able to deliver a 360° view of the challenges, trends, and issues impacting your industry.

The first step of our 360° Research Methodology™ involves conducting extensive primary research, which involves gathering first-hand information through interviews, surveys, and interactions with industry experts, key stakeholders, and market participants. This approach enables us to gather valuable insights and perspectives directly from the source.

Secondary research is another crucial component of our methodology. It involves a deep dive into various data sources, including industry reports, market databases, scholarly articles, and regulatory documents. This helps us gather a wide range of information, validate findings, and provide a comprehensive understanding of the industry landscape.

Furthermore, our methodology incorporates technology-based research techniques, such as data mining, text analytics, and predictive modelling, to uncover hidden patterns, correlations, and trends within the data. This data-driven approach enhances the accuracy and reliability of our analysis, enabling us to make informed and actionable recommendations.

In addition, our analysts bring their industry expertise and domain knowledge to bear on the research process. Their deep understanding of market dynamics, emerging trends, and future prospects allows for insightful interpretation of the data and identification of strategic opportunities.

To ensure the highest level of quality and reliability, our research process undergoes rigorous validation and verification. This includes cross-referencing and triangulation of data from multiple sources, as well as peer reviews and expert consultations.

The result of our 360° Research Methodology is a comprehensive and robust research report that empowers you to make well-informed business decisions. It provides a panoramic view of the industry landscape, helping you navigate challenges, seize opportunities, and stay ahead of the competition.

In summary, our 360° Research Methodology is designed to provide you with a deep understanding of your industry by integrating various research techniques, industry expertise, and data-driven analysis. It ensures that every business decision you make is based on a well-triangulated and comprehensive research experience.

• Product Planning Strategy

• New Product Stratergy

• Expanded Research Scope

• Comprehensive Research

• Strategic Consulting

• Provocative and pragmatic

• Accelerate Revenue & Growth

• Evaluate the competitive landscape

• Optimize your partner network

• Analyzing industries

• Mapping trends

• Strategizing growth

• Implementing plans

Covered Key Topics

Growth Opportunities

Market Growth Drivers

Leading Market Players

Company Market Share

Market Size and Growth Rate

Market Trend and Technological

Research Assistance

We will be happy to help you find what you need. Please call us or write to us:

+1 510-730-3200 (USA Number)

Email: sales@marketdigits.com