- Home

- Information Technology

-

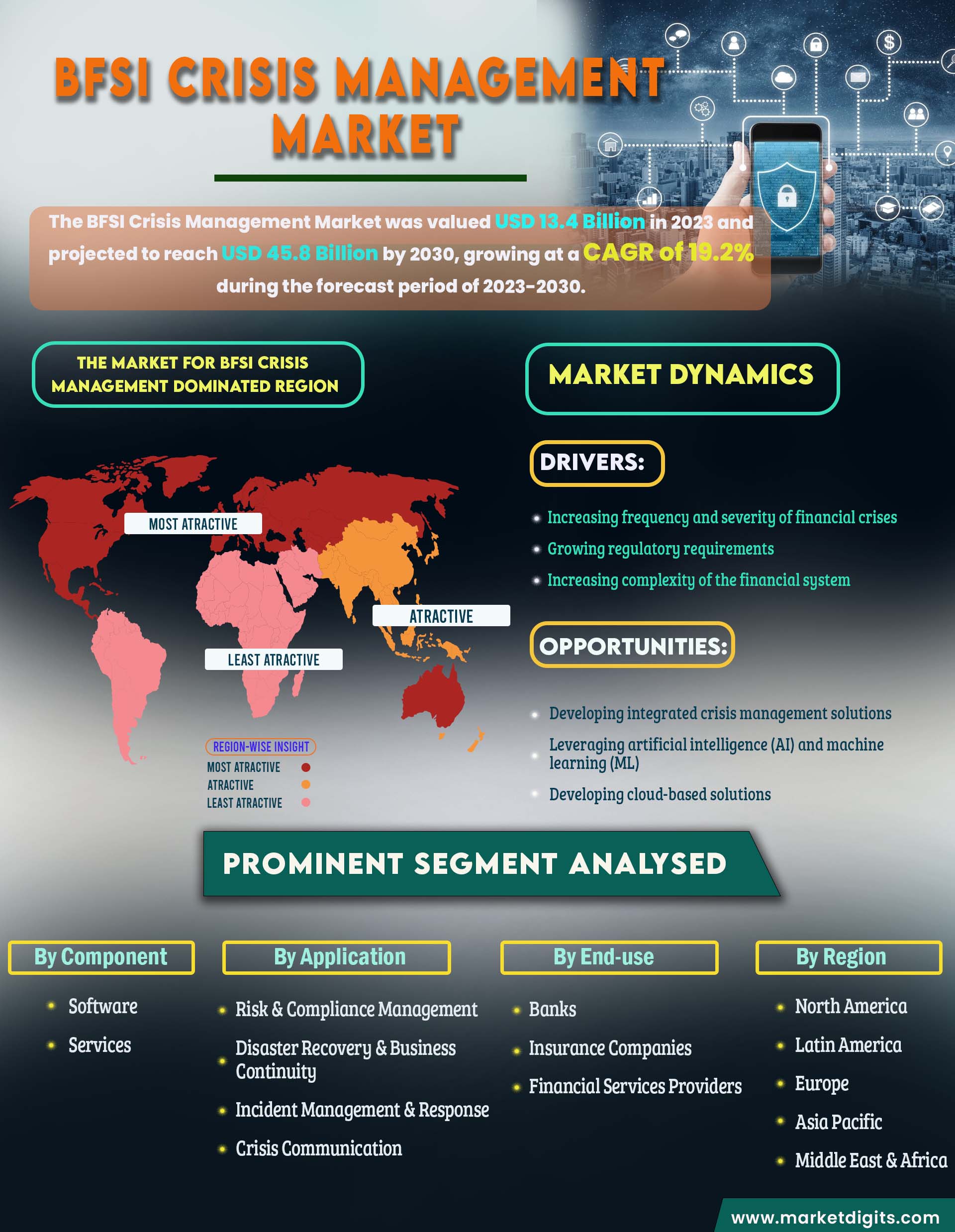

BFSI Crisis Management Market

BFSI Crisis Management Market , By Component (Software, Services), Deployment (On-Premise, Cloud), Enterprise (Large Enterprises, Small and Medium Enterprises), Application (Risk & Compliance Management, Disaster Recovery & Business Continuity, Incident Management & Response, Crisis Communication, Others), End-user (Banks, Insurance Companies, Financial Services Providers, and Region - Partner & Customer Ecosystem (Product Services, Proposition & Key Features) Competitive Index & Regional Footprints by MarketDigits - Forecast 2024-2032

Industry : Information Technology | Pages : 193 Pages | Published On : Apr 2024

Market Overview

Crisis management involves the implementation of strategies aimed at assisting organizations in navigating significant and abrupt negative events. These crises often stem from unforeseen consequences of events that were initially identified as potential risks. The purpose of crisis management is to enable organizations, including those in the Banking, Financial Services, and Insurance (BFSI) sector, to swiftly make decisions that mitigate damage during unforeseen circumstances. In the BFSI domain, crisis management specifically focuses on handling or preventing crises in banking, insurance, and finance businesses. Preparedness is crucial for companies to effectively manage any potential crisis, ensuring customer satisfaction with their response. The market for BFSI crisis management experiences substantial growth driven by increased reliance on crisis management software and solutions within financial institutions and banks. This technology offers digitalized solutions encompassing fraud detection, risk minimization, and incident and compliance management, thereby acting as a significant catalyst for market expansion.

Major vendors in the global BFSI Crisis Management Market : NCC Group, LogicGate, Inc., MetricStream, 4C Strategies, IBM, CURA, Everbridge, SAS Institute Inc., Deloitte, RQA Europe Ltd, Noggin, MetricStream Inc., CURA Software Solutions, Konexus, RQA Europe Ltd and Others

Growing demand for risk mitigation and fraud detection

The burgeoning demand for risk mitigation and fraud detection stands as a pivotal driver for the BFSI (Banking, Financial Services, and Insurance) Crisis Management Market. As financial institutions grapple with an ever-evolving landscape of risks and sophisticated fraud threats, there is a heightened emphasis on deploying advanced crisis management solutions. These tools not only enable proactive risk mitigation but also bolster fraud detection capabilities, crucial for safeguarding sensitive financial data and maintaining the integrity of transactions. The increasing integration of technologies such as artificial intelligence and machine learning in crisis management solutions empowers the BFSI sector to stay ahead of emerging risks, enhancing its ability to swiftly identify and address potential crises before they escalate. This growing recognition of the importance of risk mitigation and fraud detection underscores the essential role played by crisis management solutions in fortifying the resilience of the BFSI industry.

Market Dynamics

Drivers:

- Increasing frequency and severity of financial crises

- Growing regulatory requirements

- Increasing complexity of the financial system

Opportunities:

- Developing integrated crisis management solutions

- Leveraging artificial intelligence (AI) and machine learning (ML)

- Developing cloud-based solutions

The increasing focus on crisis prevention

The BFSI (Banking, Financial Services, and Insurance) Crisis Management Market has witnessed a significant trend towards an increasing focus on crisis prevention. Financial institutions are recognizing the imperative to proactively identify and mitigate potential threats before they escalate into crises. This shift is driven by the growing complexity of cyber threats, operational vulnerabilities, and regulatory requirements. The integration of advanced technologies such as artificial intelligence, machine learning, and predictive analytics has empowered the BFSI sector to enhance its ability to detect and preemptively respond to potential crises. By prioritizing prevention over reactive measures, financial organizations aim to not only safeguard their systems, data, and operations but also to maintain customer trust and comply with stringent regulatory standards in an ever-evolving risk landscape. This trend underscores the industry's commitment to resilience and proactive risk management in the face of an increasingly dynamic and challenging environment.

The market for BFSI Crisis Management Market is dominated by North America.

North America's dominance in the BFSI Crisis Management Market can be attributed to a combination of factors, including the region's highly developed financial infrastructure, stringent regulatory frameworks, and a proactive approach towards adopting advanced technologies. The United States, in particular, is home to a large number of major financial institutions and banks that prioritize cutting-edge crisis management solutions to protect against cyber threats, operational disruptions, and compliance challenges. Additionally, the region's early recognition of the importance of crisis preparedness and risk mitigation, coupled with significant investments in cybersecurity measures, has positioned North America at the forefront of the BFSI Crisis Management Market. The region's robust cybersecurity ecosystem and a mature market for technological innovations contribute to its continued dominance as a key player in shaping the landscape of crisis management solutions within the BFSI sector.

The Asia-Pacific region is emerging as the fastest-growing market for BFSI Crisis Management due to several factors propelling the demand for advanced solutions. The region's rapid economic development, expanding financial services sector, and increasing digitalization have exposed financial institutions to a diverse range of risks, making crisis management solutions essential. Heightened awareness of cybersecurity threats, coupled with a surge in online transactions, has driven the need for robust risk mitigation and crisis response strategies in the BFSI sector. Moreover, governments across the Asia-Pacific are increasingly focusing on strengthening cybersecurity regulations, creating a conducive environment for the adoption of crisis management technologies. As financial institutions in the region recognize the critical importance of safeguarding sensitive data and ensuring business continuity, the demand for sophisticated crisis management solutions is experiencing significant growth, positioning Asia-Pacific as a dynamic and pivotal market in the BFSI sector

Cloud Segment is anticipated to hold the Largest Market Share during the Forecast Period

Based on by Deployment segment is categorized into On-premises and Cloud. The cloud segment asserted its dominance in the market, capturing a substantial 59.8% revenue share and is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) of 20.8% throughout the forecast period. The remarkable growth in the cloud sector can be attributed to its cost-effective provision of robust backup and redundancy. The market is categorized based on deployment into on-premise and cloud solutions. For BFSI entities, safeguarding data privacy and security is paramount. Additionally, the swift response time for message delivery and receipt is a significant concern for banks. Consequently, on-premise solutions offer low latency to users by minimizing external dependencies, thereby reducing the feedback loop time for message exchange between individuals.

Segmentations Analysis of BFSI Crisis Management Market: -

- By Component

- Software

- Services

- By Deployment

- On-Premise

- Cloud

- By Enterprise

- Large Enterprises

- Small & Medium Enterprises

- By Application

- Risk & Compliance Management

- Disaster Recovery & Business Continuity

- Incident Management & Response

- Crisis Communication

- Others

- By End-user

- Banks

- Insurance Companies

- Financial Services Providers

- By Region

- North America

- US

- Canada

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Rest of Latin America

- Europe

- Germany

- France

- Italy

- Spain

- U.K.

- BENELUX

- CIS & Russia

- Nordics

- Austria

- Poland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Thailand

- Indonesia

- Malaysia

- Vietnam

- Australia & New Zealand

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Nigeria

- Egypt

- Israel

- Turkey

- Rest of MEA

- North America

Answers to Following Key Questions:

- What will be the BFSI Crisis Management Market’s Trends & growth rate? What analysis has been done of the prices, sales, and volume of the top producers of BFSI Crisis Management Market?

- What are the main forces behind worldwide BFSI Crisis Management Market? Which companies dominate BFSI Crisis Management Market?

- Which companies dominate BFSI Crisis Management Market? Which business possibilities, dangers, and tactics did they embrace in the market?

- What are the global BFSI Crisis Management industry's suppliers' opportunities and dangers in BFSI Crisis Management Market?

- What is the BFSI Crisis Management industry's regional sales, income, and pricing analysis? In the BFSI Crisis Management Market, who are the distributors, traders, and resellers?

- What are the main geographic areas for various trades that are anticipated to have astounding expansion over the BFSI Crisis Management Market?

- What are the main geographical areas for various industries that are anticipated to observe astounding expansion for BFSI Crisis Management Market?

- What are the dominant revenue-generating regions for BFSI Crisis Management Market, as well as regional growth trends?

- By the end of the forecast period, what will the market size and growth rate be?

- What are the main BFSI Crisis Management Market trends that are influencing the market's expansion?

- Which key product categories dominate BFSI Crisis Management Market? What is BFSI Crisis Management Market’s main applications?

- In the coming years, which BFSI Crisis Management Market technology will dominate the market?

Reason to purchase this BFSI Crisis Management Market Report:

- Determine prospective investment areas based on a detailed trend analysis of the global BFSI Crisis Management Market over the next years.

- Gain an in-depth understanding of the underlying factors driving demand for different BFSI Crisis Management Market segments in the top spending countries across the world and identify the opportunities each offers.

- Strengthen your understanding of the market in terms of demand drivers, industry trends, and the latest technological developments, among others.

- Identify the major channels that are driving the global BFSI Crisis Management Market, providing a clear picture of future opportunities that can be tapped, resulting in revenue expansion.

- Channelize resources by focusing on the ongoing programs that are being undertaken by the different countries within the global BFSI Crisis Management Market.

- Make correct business decisions based on a thorough analysis of the total competitive landscape of the sector with detailed profiles of the top BFSI Crisis Management Market providers worldwide, including information about their products, alliances, recent contract wins, and financial analysis wherever available.

Cloud Engineering Market Size, Share & Trends Analysis, By Deployment (Public, Private, Hybrid), By Service (IaaS, PaaS, SaaS), By Workload, By Enterprise Size By End-use, By Region, And Segment Forecasts

TOC

Table and Figures

Methodology:

At MarketDigits, we take immense pride in our 360° Research Methodology, which serves as the cornerstone of our research process. It represents a rigorous and comprehensive approach that goes beyond traditional methods to provide a holistic understanding of industry dynamics.

This methodology is built upon the integration of all seven research methodologies developed by MarketDigits, a renowned global research and consulting firm. By leveraging the collective strength of these methodologies, we are able to deliver a 360° view of the challenges, trends, and issues impacting your industry.

The first step of our 360° Research Methodology™ involves conducting extensive primary research, which involves gathering first-hand information through interviews, surveys, and interactions with industry experts, key stakeholders, and market participants. This approach enables us to gather valuable insights and perspectives directly from the source.

Secondary research is another crucial component of our methodology. It involves a deep dive into various data sources, including industry reports, market databases, scholarly articles, and regulatory documents. This helps us gather a wide range of information, validate findings, and provide a comprehensive understanding of the industry landscape.

Furthermore, our methodology incorporates technology-based research techniques, such as data mining, text analytics, and predictive modelling, to uncover hidden patterns, correlations, and trends within the data. This data-driven approach enhances the accuracy and reliability of our analysis, enabling us to make informed and actionable recommendations.

In addition, our analysts bring their industry expertise and domain knowledge to bear on the research process. Their deep understanding of market dynamics, emerging trends, and future prospects allows for insightful interpretation of the data and identification of strategic opportunities.

To ensure the highest level of quality and reliability, our research process undergoes rigorous validation and verification. This includes cross-referencing and triangulation of data from multiple sources, as well as peer reviews and expert consultations.

The result of our 360° Research Methodology is a comprehensive and robust research report that empowers you to make well-informed business decisions. It provides a panoramic view of the industry landscape, helping you navigate challenges, seize opportunities, and stay ahead of the competition.

In summary, our 360° Research Methodology is designed to provide you with a deep understanding of your industry by integrating various research techniques, industry expertise, and data-driven analysis. It ensures that every business decision you make is based on a well-triangulated and comprehensive research experience.

• Product Planning Strategy

• New Product Stratergy

• Expanded Research Scope

• Comprehensive Research

• Strategic Consulting

• Provocative and pragmatic

• Accelerate Revenue & Growth

• Evaluate the competitive landscape

• Optimize your partner network

• Analyzing industries

• Mapping trends

• Strategizing growth

• Implementing plans

Covered Key Topics

Growth Opportunities

Market Growth Drivers

Leading Market Players

Company Market Share

Market Size and Growth Rate

Market Trend and Technological

Research Assistance

We will be happy to help you find what you need. Please call us or write to us:

+1 510-730-3200 (USA Number)

Email: sales@marketdigits.com