- Home

- Information Technology

-

3D Printing Metals Market

3D Printing Metals Market by Metal Type (Titanium, Nickel, Stainless Steel, Aluminum), End-Use Industry (A&D, Automotive, Medical & Dental), Form (Powder, Filament), Technology (Pbf, Ded, Binder Jetting, Metal Extrusion), Partner & Customer Ecosystem (Product Services, Proposition & Key Features) Competitive Index & Regional Footprints by MarketDigits - Forecast 2024 – 2032

Industry : Information Technology | Pages : 173 Pages | Upcoming : Jun 2024

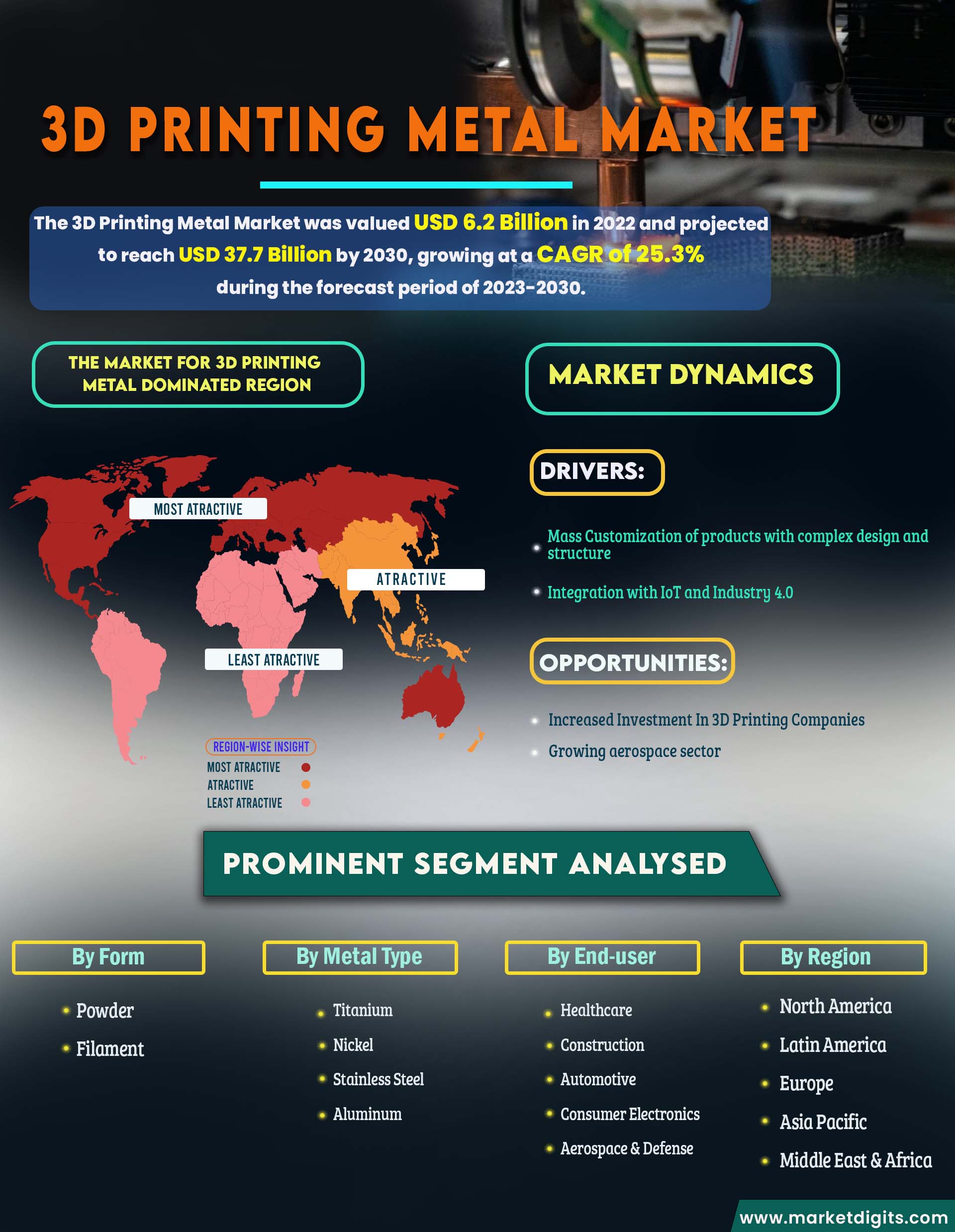

The 3D printing metals market achieved a valuation of USD 1,800.2 million in 2022 and is anticipated to reach USD 5,542.7 million by 2030, exhibiting a compound annual growth rate (CAGR) of 32.5% from 2023 to 2030. The market growth is primarily driven by the increasing demand for 3D printed metals from the aerospace & defense and automotive industries, as well as the growing trend of mass customization for products with intricate designs and structures. Additionally, the ability of 3D printing metal technology to reduce manufacturing costs, lead times, and waste generation further contributes to the market's expansion.

Dynamics of the 3D Printing Metals Market

Driver: Mass Customization of products with intricate designs and structures

Mass customization has become a prominent trend in the 3D printing industry. This technology enables consumers to create and print their unique designs, offering a new level of personalization. In the 3D printing metals market, the focus is on providing customized lightweight products at affordable prices through mass production. 3D printing facilitates the realization of complex and customized designs, enhancing its appeal in various industries.

Restraint: Limitation of printer size

A constraint in the 3D printing metals market is the size limitation imposed by the build platform of the printers. Each printer has a specific build platform size, typically ranging from 250 × 250 × 300 mm to larger dimensions like 400 × 400 × 380 mm. The printed parts must be smaller than the printer's build platform because the metal tends to shrink during the cooling process after sintering. While there are printers capable of manufacturing larger parts, they are expensive and not feasible for many companies. Moreover, larger-sized products require more time to print. The size limitation of printed parts significantly impacts market growth.

Opportunity: Potential for enhancing manufacturing and supply chain management

The rapidly growing 3D printing metals market has the potential to revolutionize manufacturing and supply chain management. Metal 3D printing offers advantages such as mass customization and short production runs. Unlike traditional manufacturing processes, metal 3D printing eliminates the need for tooling, reducing upfront costs. While conventional manufacturing may have lower costs per unit produced, it incurs high tooling expenses and is more expensive for low-volume manufacturing. Metal 3D printing also helps in minimizing waste generation during the manufacturing process by employing a layer-by-layer approach to build parts.

Challenge: Specific material requirements

The high cost of 3D printing metals poses a significant challenge to market growth, primarily due to the specific requirements of metal powders used in the process. Metal powders must be converted into spherical shapes to achieve optimal packing characteristics and flow properties. The spherical shape of the powder also influences the density and mechanical properties of the final product, ensuring layer consistency. Meeting these material requirements for metal powders presents a challenge for manufacturers of 3D printed metal products.

The powder segment is set to dominate the 3D printing metal market in 2021. Metal powders, which are commonly available in a spherical shape, enable the production of high-density products with complex geometries. The powder form significantly influences the density, mechanical properties, and layer consistency of the final 3D printed products. The increasing demand for 3D printed products with high-density and strength has fueled the demand for metal powders.

Within the 3D printing metal market, the powder bed fusion technique is expected to hold the largest share in 2022. This technology excels in creating lightweight parts and components using advanced computer-aided design (CAD) processes like topology optimization. Powder bed fusion is widely utilized in the automotive and aerospace industries to manufacture 3D printed metal parts with intricate details and high accuracy.

During the forecast period, the titanium segment is anticipated to have the largest share in the 3D printing metals market. The growth of this segment is driven by the increasing demand for 3D printed metal parts in the aerospace & defense and automotive industries. Titanium possesses exceptional properties such as high impact resistance and resistance to high temperatures. It finds applications in the medical and dental industry for producing orthopedic and dental implants, as well as artificial knee and hip replacements.

The aerospace & defense industry is projected to be the fastest-growing end-use industry in the 3D printing metals market. Metal 3D printing is employed to manufacture critical engine components and fuel nozzles in the aerospace & defense sector, demanding precise and accurate production. By utilizing 3D printing, the overall weight of aircraft can be reduced, leading to decreased fuel consumption. Additionally, specific brackets for satellites can be manufactured using 3D printing metals without altering mold designs and manufacturing processes. The increasing demand for critical engineering and fabrication applications in the aerospace & defense industry is a key driver for this segment.

In terms of regional growth, the Asia Pacific region is projected to have the highest compound annual growth rate (CAGR) during the forecast period. China is currently estimated to be the largest market for 3D printing metals in the Asia Pacific region. Established metal printer and powder manufacturers from North America and Europe are expanding their presence in Asia Pacific through various growth strategies.

3D Printing Metals Market Players

3D Systems Corporation (US), Stratasys Ltd. (US), Renishaw plc (UK), General Electric Company (US), Carpenter Technology Corporation (US), Materialise NV (Belgium), Voxeljet AG (Germany), Sandvik AB (Sweden), EOS GmbH Electro Optical Systems (Germany), The ExOne Company (US), and Proto Labs, Inc. (US) are some of the major players in the 3D printing metals market. These players have been focusing on strategies such as acquisitions, new product launches, contracts, and collaborations that help them expand their businesses in untapped and potential markets. They have been adopting various organic and inorganic growth strategies to enhance their position in the 3D printing metal market.

This report categorizes the 3D printing metals market based on form, technology, metal type, end-use industry, and region.

By form, the 3D printing metals market is segmented as follows:

• Powder

• Filament

By technology, the 3D printing metals market is segmented as follows:

• Powder Bed Fusion

• Directed Energy Deposition

• Binder Jetting

• Metal Extrusion

• Others (Digital Light Projector, Multi-jet Fusion, and Material Jetting)

By metal type, the 3D printing metals market is segmented as follows:

• Titanium

• Nickel

• Stainless Steel

• Aluminum

• Others (Cobalt-chrome, Copper, Silver, Gold, and Bronze)

By end-use industry, the 3D printing metals market is segmented as follows:

• Aerospace & Defense

• Automotive

• Medical & Dental

• Others (Marine, Art & Sculpture, Jewelry, and Architecture)

By region, the 3D printing metals market is segmented as follows:

• North America

• Europe

• Asia Pacific

• Middle East & Africa

• South America

Recent Developments

• In November 2019, Renishaw plc collaborated with Sandvik Additive Manufacturing to qualify new additive manufacturing (AM) materials for production applications. These materials include a range of metal powders and new alloy compositions that can be optimized for the laser powder bed fusion (LPBF) process and superior material properties. With this collaboration, Renishaw plc developed new metal materials for 3D printing.

• In October 2019, GE Additive entered into a five-year cooperative research and development agreement (CRADA) with the US Department of Energy’s Oak Ridge National Laboratory (ORNL). The agreement was focused on the processes, materials, and software to increase customer adaptability towards additive manufacturing from conventional manufacturing.

• In July 2019, 3D Systems Corporation was awarded a contract worth USD 15 million from the Combat Capabilities Development Command Army Research Laboratory (ARL), to create the world’s largest, fastest, and precise 3D printer. This contract will increase the consumption of 3D printed metal parts & components in the aerospace and defense industry. The contract helped the company increase its product portfolio.

In March 2019, Stratasys Direct Manufacturing, a subsidiary of Stratasys, Ltd. expanded its Metal 3D printing production with VELO3D’s Sapphire 3D print system and Flow software. The expansion was done to meet the increasing demand for 3D metal products for several applications. This expansion helped the company meet the customer demand for 3D metal printed products in North America.

Cloud Engineering Market Size, Share & Trends Analysis, By Deployment (Public, Private, Hybrid), By Service (IaaS, PaaS, SaaS), By Workload, By Enterprise Size By End-use, By Region, And Segment Forecasts

TOC

Table and Figures

Methodology:

At MarketDigits, we take immense pride in our 360° Research Methodology, which serves as the cornerstone of our research process. It represents a rigorous and comprehensive approach that goes beyond traditional methods to provide a holistic understanding of industry dynamics.

This methodology is built upon the integration of all seven research methodologies developed by MarketDigits, a renowned global research and consulting firm. By leveraging the collective strength of these methodologies, we are able to deliver a 360° view of the challenges, trends, and issues impacting your industry.

The first step of our 360° Research Methodology™ involves conducting extensive primary research, which involves gathering first-hand information through interviews, surveys, and interactions with industry experts, key stakeholders, and market participants. This approach enables us to gather valuable insights and perspectives directly from the source.

Secondary research is another crucial component of our methodology. It involves a deep dive into various data sources, including industry reports, market databases, scholarly articles, and regulatory documents. This helps us gather a wide range of information, validate findings, and provide a comprehensive understanding of the industry landscape.

Furthermore, our methodology incorporates technology-based research techniques, such as data mining, text analytics, and predictive modelling, to uncover hidden patterns, correlations, and trends within the data. This data-driven approach enhances the accuracy and reliability of our analysis, enabling us to make informed and actionable recommendations.

In addition, our analysts bring their industry expertise and domain knowledge to bear on the research process. Their deep understanding of market dynamics, emerging trends, and future prospects allows for insightful interpretation of the data and identification of strategic opportunities.

To ensure the highest level of quality and reliability, our research process undergoes rigorous validation and verification. This includes cross-referencing and triangulation of data from multiple sources, as well as peer reviews and expert consultations.

The result of our 360° Research Methodology is a comprehensive and robust research report that empowers you to make well-informed business decisions. It provides a panoramic view of the industry landscape, helping you navigate challenges, seize opportunities, and stay ahead of the competition.

In summary, our 360° Research Methodology is designed to provide you with a deep understanding of your industry by integrating various research techniques, industry expertise, and data-driven analysis. It ensures that every business decision you make is based on a well-triangulated and comprehensive research experience.

• Product Planning Strategy

• New Product Stratergy

• Expanded Research Scope

• Comprehensive Research

• Strategic Consulting

• Provocative and pragmatic

• Accelerate Revenue & Growth

• Evaluate the competitive landscape

• Optimize your partner network

• Analyzing industries

• Mapping trends

• Strategizing growth

• Implementing plans

Covered Key Topics

Growth Opportunities

Market Growth Drivers

Leading Market Players

Company Market Share

Market Size and Growth Rate

Market Trend and Technological

Research Assistance

We will be happy to help you find what you need. Please call us or write to us:

+1 510-730-3200 (USA Number)

Email: sales@marketdigits.com